Finance masters courses show strengths amid pandemic

Business schools hope MiFs will thrive as students pursue degrees with ‘employability’

Sometimes it pays to be obvious. The masters in finance (MiF) degree does what it says on the tin, equipping postgraduate students with skills in accounting, corporate finance and econometrics for roles in banking, insurance and any sector requiring such knowhow.

The MiF has fared better than other courses in what has been a difficult few years for graduate management education — with more US MBA programmes reporting applications declines than growth for four straight years.

Two-thirds of all business school applicants consider a specialist business masters degree, with MiF courses the most popular programme in this group, according to business school entrance exam administrator the Graduate Management Admission Council (GMAC).

However, this option has not been able to sidestep the overall drop in demand. Just over half of all MiF courses reported declining applications in 2019, driven by reduced demand from international candidates, who make up the majority of their applicant pools.

For those still intent on doing an MiF, employability is a big attraction. “There has always been this tighter coupling of what the [MiF] curriculum offers and what the outcome is in terms of jobs,” says Rahul Choudaha, director of industry insights and research communications at GMAC. “These candidates become more employable than others.”

Empty quarter: a passenger walks through a deserted airport terminal in Munich. Travel restrictions designed to contain coronavirus may mean fewer overseas students in next year’s MiF classes © AFP via Getty Images

This last factor will become even more important this year if, as expected, unemployment rates surge in many countries in the wake of coronavirus. MiF students will not escape the impact of what is expected to be the worst global slump in several generations.

Campus closures mean that classes for the next academic year are likely to at least begin with online-only teaching for many courses. Meanwhile travel restrictions designed to contain the pandemic are likely to affect MiF programmes’ ability to attract a much higher percentage of overseas students than other postgraduate courses.

According to Mr Choudaha, international mobility is “one of the biggest risks and challenges for all business school programmes at this point of time.”

Yet filling classes is likely to become less of a problem because of the economic crunch.

Students completing bachelor’s degrees may conclude that this is a good moment to remain in full-time education, while graduates with a few years’ work experience may feel the need to upgrade their credentials.

However, the new intake will be less diverse in terms of nationalities. That will make it harder for course administrators to recreate the range of views found in more multicultural classes, which catalyse the debates that are the bedrock of business school teaching.

Business not quite as usual: Vlerick has offered more places than ever for its MiF course, but anticipates a fall in overseas students

Belgium’s Vlerick Business School, which has been among the FT’s top 30 MiF providers for several years, has been able to offer a record number of places for the course starting this autumn because of the volume and quality of applications it has received.

“We have been overwhelmed by applications in the weeks following the lockdown,” says Wouter De Maeseneire, programme director of the school’s masters in financial management course.

“Given the prospects for graduates of the masters in finance, even compared with other postgraduate courses, we are a popular choice. [Belgian] students who might have gone to Paris or London to study are now deciding to stay at home because of the travel restrictions.”

“One of the biggest risks for all business school programmes at this point is international mobility

Rahul Choudaha, director of industry insights and research communications at GMAC”

But what will be lacking at Vlerick this year are large numbers of students arriving from overseas. Up to 40 per cent of the school’s annual intake is usually from outside Belgium, according to Mr De Maeseneire. Next academic year it could be as little as a quarter of the class, and from countries much closer to home, he says.

“Even [among] those who have registered, we are not sure that they will get the necessary approval to travel in time,” Mr De Maeseneire adds. “It is a pity because we want to be recognised as an international business school, but it might mean that we have to teach more classes online.”

The shift to completely online tuition has been the challenge of recent months for MiF faculty as much as for other degree programmes, with Vlerick using Zoom for online lectures. “For me it is a bit sad that students have to end their academic year this way, but the bottom line is that it works,” Mr De Maeseneire says.

Being able to teach lessons online has also been a saving grace in terms of including students from further afield, he adds.

Other schools face similar challenges, but MiF programme directors have become used to innovating in recent years because the finance sector is changing so much.

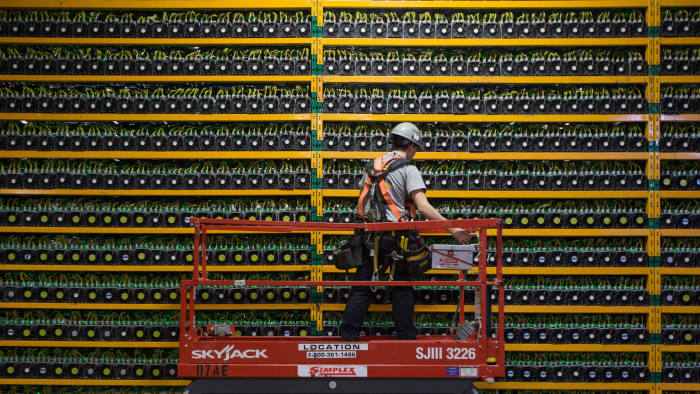

Winning formula? A bitcoin mining operation in Canada. Digital currencies are a popular specialism for finance students © AFP

Finance can suffer from being a rather dry subject, but the digitisation of cash and economies is creating opportunities for targeted MiF programmes designed to appeal to students interested in areas such as big data and cryptocurrencies.

One of the most popular specialisms is fintech — financial technology, particularly start-ups — which demands a grasp of algorithms not historically taught on MiF courses, as well as immersion in computer modelling.

Another is computational finance, where students focus on statistical techniques and programming languages.

A third subject area, digital currencies and blockchain, has been “a shining light” even among specialist business programmes in recent years, according to Tim Mescon, executive vice-president and chief officer for Europe, the Middle East and Africa for AACSB International, the business education umbrella organisation.

“[It offers] a broad range of opportunities in what are red-hot job markets, in fact probably more so because of the disruption caused to banking by coronavirus,” he says.

There is a particular opportunity for schools that can teach these disciplines online. Mr Mescon points to the University of Nicosia, whose online masters degree in digital currency has attracted students from around the world.

“Cyprus is a beautiful country but this was not a destination location for study,” Mr Mescon notes. “This degree course has made it one.”